Although the theory of the butterfly effect has existed for decades, in recent years, globalization has magnified its impact and made it more immediate.

When the United Kingdom voted to leave the European Union last June, financial markets around the world went into an unprecedented tailspin. In the United States, the shock wave wiped out all gains that the Dow Jones and the S&P 500 had made in 2016. A few months later, Trump was voted into office. The effects of a globalized economy are not only felt on financial markets; they also impact our values and our trust in current socio-economic models.

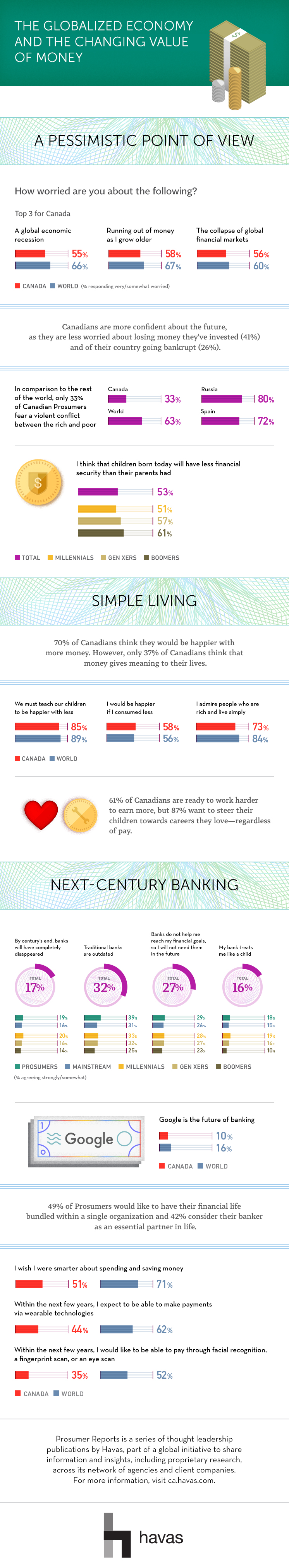

For our most recent Prosumer Report, Money Money Mon€y: Attitudes Toward Credit, Consumption, and Cryptocurrency, we surveyed some 12,000 people across 37 countries about today’s biggest money questions, including how they perceive money and new methods of payment, as well as their feelings about consumption. The results demonstrate a high level of pessimism about the capitalist model and faltering confidence in financial and banking systems.

A pessimistic vision of the future

The repercussions of the big 2008 recession are still being felt, with a considerable number of people still feeling vulnerable about their financial future. Unsurprisingly, 70% of respondents reported worrying about their ability to provide for themselves upon retirement.

Data collected during the study also confirms that 67% of Canadians believe that children born today will be less financially secure than their parents. The numbers are darker still when we look at China, where 42% of respondents believe that their financial security will get worse in the years to come.

A new perspective on capitalism

With the fall of the Berlin Wall, liberalism clearly won out over communism. That said, only a few months after the Brexit vote and Trump’s victory in the U.S. Presidential election, the new portrait of world politics is creating jitters among supporters of global free-trade.

This effect has even been felt in Quebec, with Sophie Brochu, CEO of Gaz Métro, recently making a plea for a more gentle and humane form of capitalism. Not surprising then, that this report reveals that Canadians feel betrayed by capitalism. In fact, Canadians no longer feel as if working hard will reap financial rewards, one of the cornerstones of capitalism. More precisely, only 30% of them still believe in the link between hard work and success. However, one thing remains certain: the problem goes well beyond a growing malaise over the unequal distribution of wealth between the haves and the have-nots.

The changing value of money

Our study also confirmed a trend towards minimalism and austerity–lifestyles that serve as an antidote to mindless consumption and the wasting of resources. Adopting a more frugal lifestyle in our current economic context is also seen as a proactive response to this current pessimistic mood as it teaches us to make better decisions. After all, if you want to take that vacation, you’ll have to tighten that belt and cut day-to-day spending.

This attitude towards money is particularly obvious in Canada. Even if 65% of Canadians claim that having more money wouldn’t make them any happier, they still long for the freedom and security it affords. The goal is to have enough money so that you don’t have to worry about having money.

Banks must prepare for the future

Emerging currencies, new financial technology (fintech) companies and the appearance of alternative payment options (ex. bitcoin) are forcing banks to reinvent how they do things in order to stay competitive.

Although Canadians still believe in the relevancy of traditional banking and are not yet ready to trust new-fangled banking services, they nonetheless want their banks to more actively help them fulfill various needs. In light of the fact that 27% of Canadians view their bank as failing to help them reach their financial goals, banks obviously still have a lot of work to do if these needs are to be met.

Furthermore, banks shouldn’t be the only ones worrying about our new attitudes towards money and consumption. To stay relevant in years to come, brands will also have to be more sensitive to the new concerns that consumers are facing. Examples include adapting to the budgetary constraints of customers, which is what Everytable does with its pay-what-you-can model, or catering to their new decluttered mindset, like H&M, which offers a service to recycle “used” clothing.